Asia is likely to experience disinflation, or a slower pace of inflation, in the coming months, driven by weaker underlying inflation momentum and helped by base effects. By mid-year, inflation momentum, as measured on a month-on-month, seasonally adjusted basis, should be closer to central bank targets in most economies following the monetary tightening phase last year. Most Asian central banks are now in a policy pause phase and, if underlying inflation moderates accordingly, the window to monetary easing will open up later this year.

There are seven reasons why we see faster disinflation in Asia:

#1. Asia’s inflation is driven more by supply- than demand-side factors. Lower oil and global food prices, abating currency depreciation pressures and the full normalization of pandemic-driven supply chain bottlenecks point to easing supply-side pressures. We believe the lagged effects of these easing supply-side pressures will materialize in Asia’s inflation readings in coming months.

#2. Base effects. Comparing this year’s inflation to last year’s high levels, on a monthly basis, gives rise to base effects that serve to dampen inflation in specific months.

#3. Easing food and energy prices should lower headline and core inflation. In Asia’s emerging markets, food and fuel prices drive headline inflation and can spill into core inflation due to second-round effects.

Lower food and energy prices should also curtail household inflation expectations.

#4. No wage-price spiral in Asia. Wage spikes caused by mass layoffs and early retirements in the US are not evident in Asia, where labour markets are less flexible. Instead, wage growth is starting to moderate, even in economies with tight labour markets such as Singapore. Export and manufacturing slowdowns should spill into a weaker labor market and exert downward pressure on wage growth, especially for open economies in the region.

#5. Goods disinflation. Weaker goods demand and softening input costs will likely result in a slower rise in prices of core goods.

#6. Services inflation is likely to moderate. The post-pandemic release of pent-up demand for services has been exhausted. Moderating wage growth should soothe services inflation.

#7. China is unlikely to be a source of inflation. China’s growth cycle is desynchronized from the rest of the world, and it is not a material source of inflation risk, either to itself or globally. China’s pent-up consumption demand from its reopening is likely to disappoint market expectations.

Inflation and policy implications

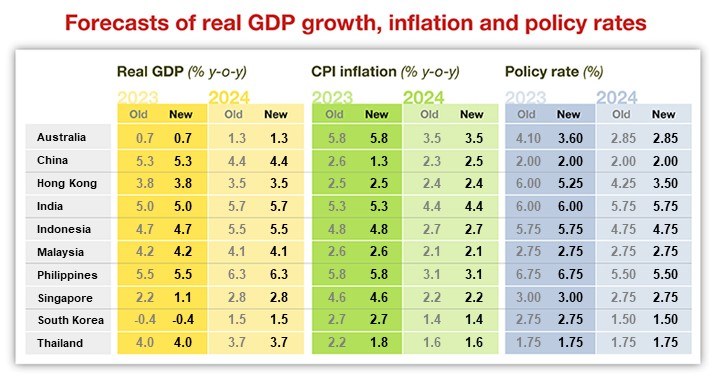

Overall, we continue to see disinflation as a significant macro theme for the coming year. Inflation in economies such as Thailand, India and South Korea are projected to moderate to within the central banks’ target ranges ahead of schedule. By contrast, inflation in Singapore and the Philippines are set to fall more slowly.

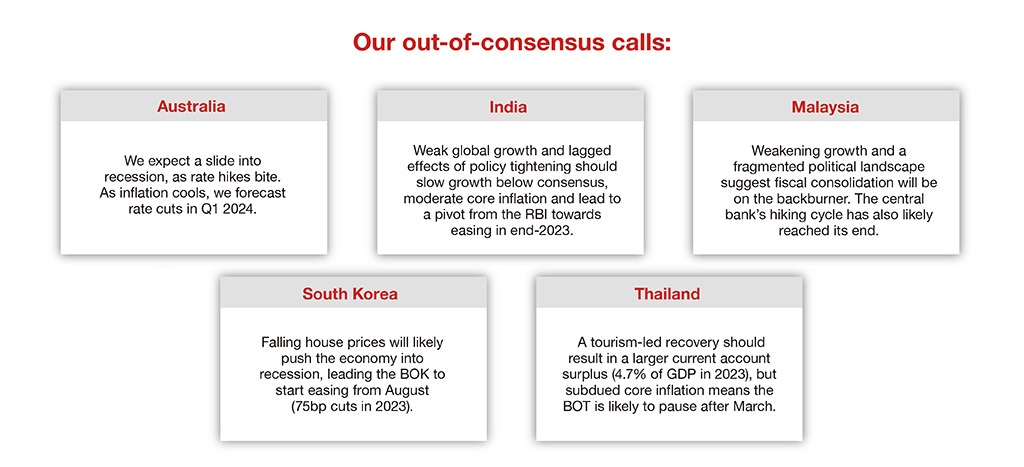

The monetary policy tightening cycle is likely over in Asia, except for the Philippines, where we still expect two 25 basis points hikes in the second quarter. The rest of Asia has entered a phase of monetary policy pause, though countries such as India, Thailand and Malaysia have left the door open for further rate hikes. As inflation momentum eases in the second half of 2023, we expect central banks to prioritize limiting the downside risks to growth in their policies. We expect South Korea and India to be the first to cut rates in August and October, respectively, but it is possible that other Asian central banks may move sooner.

For more on our 2023 growth projections, read our full report.