Asia Economic Monthly: Is Asia slowly decoupling from China?

China’s share in Asian exports is slowing and Asian lenders’ exposure to China is plateauing.

- China’s share of Asia’s exports has shrunk by the most in two decades, if not in history.

- Asia’s exports of processing goods to China may continue to moderate as supply chains are likely to continue shifting away from China.

- Credit risk spillovers from China’s property sector are unlikely to be systemic for the rest of Asia.

China still matters a great deal for the rest of Asia, but data show that China’s share of Asian exports is slowing sharply, and Asian banks’ exposure to China is plateauing. It is too early to tell, but the region’s rapid integration with China over the last two decades may be gradually unwinding.

There will always be winners and losers: trade and investment diversification should create medium-term opportunities for India and Southeast Asia.

China’s share of Asian exports has fallen sharply

China is an important trading partner for most Asian economies, but the country’s contribution to Asian exports has fallen dramatically over the last two years to 17.9% in June 2023 from 22% in April 2021. This represents the largest two-year decline in at least two decades, if not in history.

Traditionally, Asia has long provided goods to China for the country to process and re-export to meet final demand elsewhere. This is known as processing trade. According to Nomura analysis, Asia’s processing exports to China have declined, reflecting both trade diversification and trade diversion away from China. The largest fall in processing exports share occurred in economies closely intertwined with China-centered supply chains such as South Korea and Hong Kong.

The drop in Asia’s ordinary exports to China suggests the country’s own demand has weakened, consistent with the sharp growth downturn experienced over the past two years. Asia’s exports to China are typically more sensitive to China’s investment demand, especially in property construction, than to consumption and retail sales.

Beneath the aggregate decline, Southeast Asian economies have seen a visible increase or smaller fall in their share of exports to China. Nickel, iron and steel exports from Indonesia have risen, supporting our view that China is playing an important role in Indonesia’s commodity downstreaming. Thailand’s ordinary exports to China have fallen by less than the rest of Asia, reflecting increased exports of agricultural products.

Cyclically, the downturn in Asia’s exports to China is likely bottoming out, but we don’t see a speedy recovery. Our medium-term structural outlook differs. Asia’s exports of processing goods to China may continue to moderate, as the trend of supply chains shifting away from China is likely to continue. Additionally, as we expect China’s GDP growth to slow to 3.9% over the next five years, the growth impulse for the rest of Asia from China’s domestic demand is also likely to weaken, capping export growth.

Asian banks’ exposure to China appears manageable

There is a fear that China’s ongoing property crisis may result in a credit risk spillover to Asian banks. However, data from Bank for International Settlements and Nomura show that the exposure is highest for UK banks, at 2.7% of their total assets. South Korea’s exposure – at 1% of its banking system’s total assets – is one of the highest in Asia. That said, longer-term trends show that banks’ exposure to China has plateaued in Korea and moderated in Australia, another market where banks have a relatively high exposure to China, at about 0.5% of their total assets. Conclusion: Credit risk spillovers from China are unlikely to be systemic for the rest of Asia.

Three positive spillovers from China

The outbound tourism recovery from China continues at varying paces across Asia, with some hiccups on demand (via weaker Chinese household income) and supply (due to visa and flight connectivity issues). Hong Kong has experienced the fastest rebound, with Chinese tourist arrivals at 71.5% of 2019 levels, followed by Singapore at 59.4%. The recovery is at around 45% in other regions such as Thailand, Korea, Indonesia and Australia. The tourism rebound won’t offset the broader growth headwinds, but is nonetheless a positive.

Trade diversification away from China is benefiting India and ASEAN. Vietnam stands out as a key beneficiary, as supply chains have relocated from China to Vietnam across electronics, textiles and toys segments over the last 5 to 7 years. India’s electronics exports are up 42% y-o-y on a cumulative basis for the first seven months of the year, reflecting a rising global market share in smartphone assembly.

The supply chain reallocation from China is also likely to spur greater foreign direct investment into India and ASEAN. Alongside higher government spending on infrastructure, this could set off a virtuous spiral by boosting supply capacity, competitiveness and productivity. India and ASEAN are Asia’s new flock of high-flying geese, and the experience from North Asia indicates that, once foreign trade and FDI reach critical mass, stronger portfolio inflows will follow.

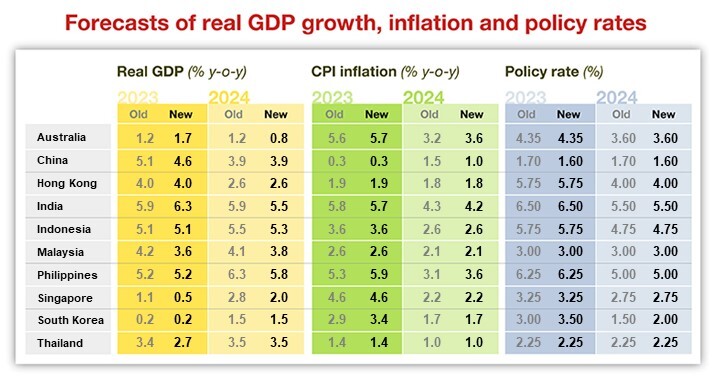

For more on our 2023 growth projections, read our full report.

Contributor

Sonal Varma

Chief Economist, India and Asia ex-Japan

Si Ying Toh

Economist, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.