Asia Economic Monthly: Estimating Asia’s Exposure to US Tariffs

In an interconnected world, the impact from higher US tariffs can sometimes ricochet beyond the target country

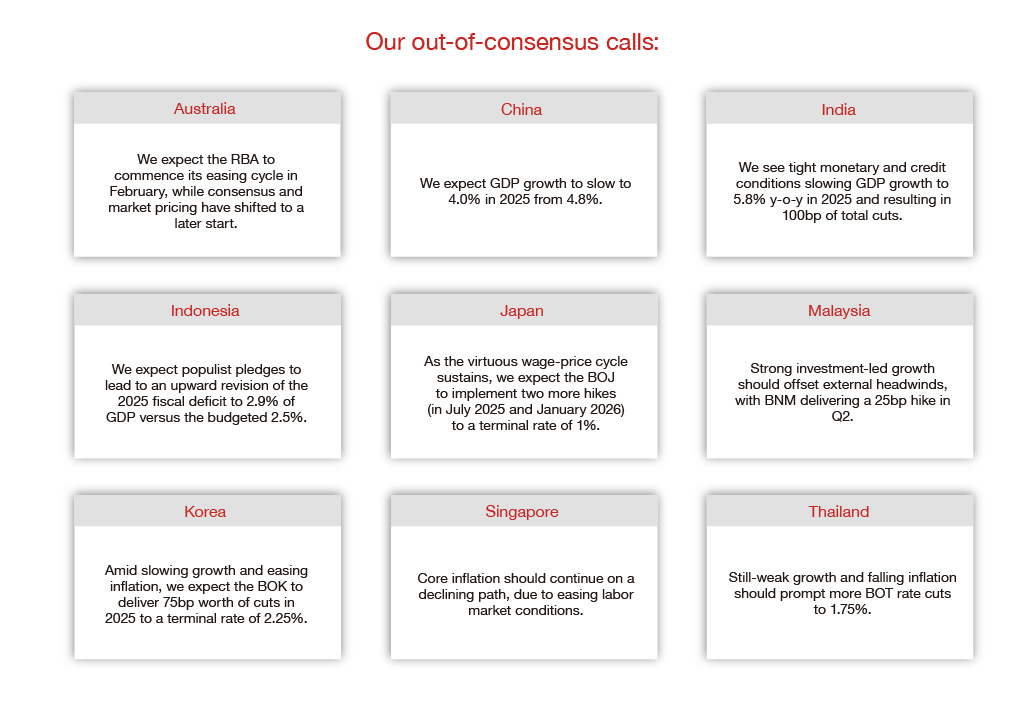

- Asia’s exports are at risk from higher US tariffs. To counter this, the region is preparing to import more from the US and raise its direct investment in US manufacturing

- Even if Asia is not directly hit with higher US tariffs, it is indirectly exposed to potential US tariffs on other countries due to the region’s backward and forward integration in global value chains

- Our estimates of Asia’s ultimate exposure to the US show that Vietnam is the most vulnerable to higher US universal tariffs, followed by Thailand, Malaysia, Singapore and South Korea

Trump, tariffs and trade policy uncertainty are back. In Asia, China is at the center of Donald Trump’s America First Trade Policy, but the rest of Asia could soon come in the line of fire too. The Office of the US Trade Representative is reviewing China’s circumvention through third countries, which will shine a spotlight on Southeast Asia. Countries that run large and persistent annual goods trade surpluses with the US include China, Vietnam, Japan, South Korea, Thailand and India, among others. The president’s executive order calls for reviewing existing free trade agreements — which in Asia includes Australia, South Korea and Singapore — and countries that manipulate their currencies and provide transnational subsidies, which could put more Asian economies in the spotlight.

In sum, Asia’s exports to the US are at risk, according to Nomura analysis.

Measuring Asia’s gross exposure to the US

A clean way to estimate Asia’s direct exposure to the US is by looking at the share of Asia’s exports to the US. The relatively open economies of Vietnam, Thailand and Malaysia are most exposed to higher US tariffs. By sector, electronics, machinery, motor vehicles and other manufactured products are most exposed.

Vietnam appears most at risk in Asia; its exports to the US account for a quarter of its GDP and are composed mainly of textiles and electronics. For Malaysia, over 60% of its exports to the US are electronics products. The impact on Thailand could be more broad-based across electronics, rubber products and machinery exports. Other Asian economies have a more diverse exposure to the US. For example, around 14% of Singapore’s exports to the US are chemicals and pharmaceuticals, while India exports mainly precious stones, textiles and pharmaceuticals. Motor vehicle exports are more important for South Korea and Japan than their exports of electronics to the US.

Indeed, given Asia’s large exposure to potential US tariffs, the region is preparing to import more energy, agricultural goods, defense equipment, aircraft and medical equipment from the US, and raise its direct investment in US manufacturing.

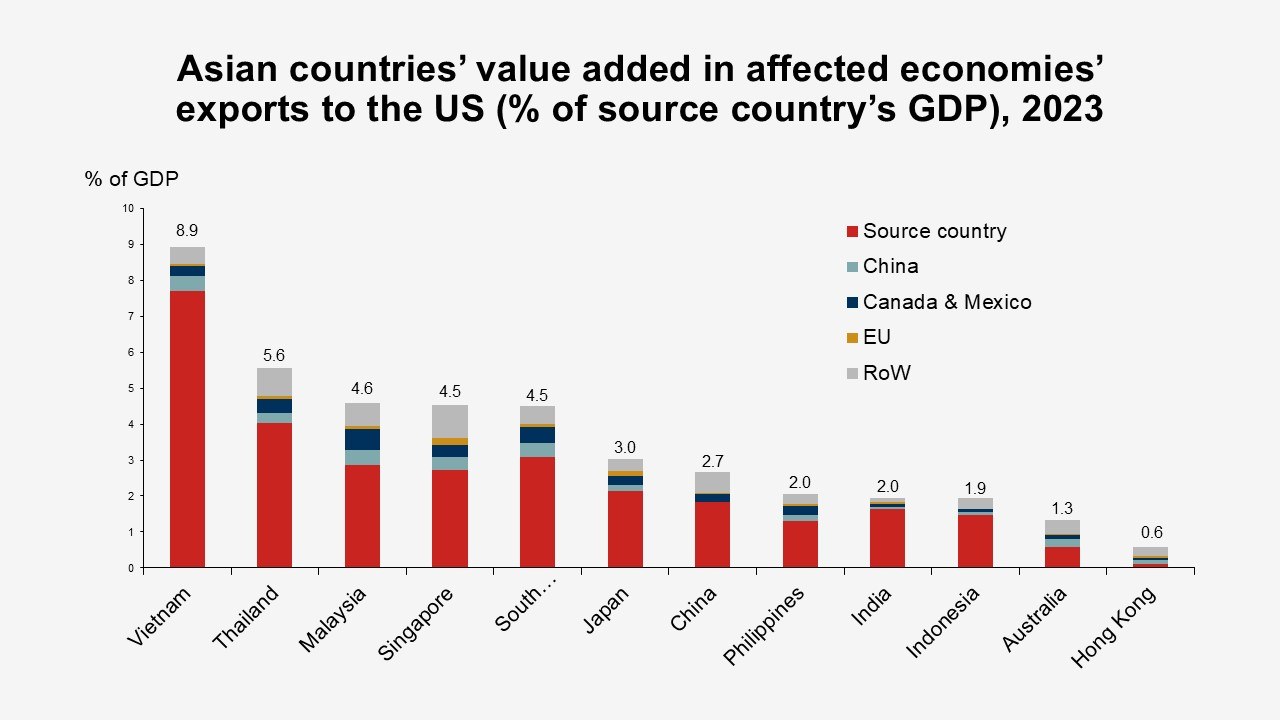

Measuring Asia’s ultimate exposure to the US

Asia’s gross exports to the US, however, may not accurately capture the region’s ultimate exposure to the country. This is because Asian economies are an intricate part of global supply chain networks, with both backward and forward integration. For instance, Vietnam imports intermediate products from elsewhere, assembles them, and then re-exports to the US — backward integration. It also exports intermediate products to Mexico, which are then re-exported to the US — forward integration.

To capture Asia’s ultimate exposure to the US, we need to estimate a country’s value added in its exports to the US, both directly and indirectly via third countries. This concept of value addition is important because, even if Asia is not directly hit with higher US tariffs, it is still indirectly exposed to potential tariffs on other countries due to their backward and forward integration in global value chains.

Who is exposed to US tariffs on China

Undoubtedly, China faces the highest risk, with its value added in exports to the US at a high of 1.8% of GDP. Among other Asian economies, Vietnam, Malaysia and South Korea could also be adversely impacted, mostly in the electronics sector.

Who is exposed to US tariffs on Canada and Mexico

Our estimates suggest that higher tariffs on Mexico and Canada would hurt Malaysia, Thailand, South Korea and Singapore the most, mainly in the electronics sector. Given Mexico’s status as an auto assembly hub, higher tariffs on Mexico would also adversely impact South Korea’s motor vehicle exports.

Who is exposed to US tariffs on the European Union

US tariffs on the EU could hurt Asia’s chemical and pharmaceutical sectors the most. The impact would be most significant for Singapore and Japan. Both have free trade agreements with the EU, which imports their products, develops them and then redistributes them to the more profitable US market. After pharmaceuticals, Asia’s auto exports could also be hurt, especially those from South Korea, which has a free trade agreement with the EU.

Is Asia more exposed to US tariffs on China or Mexico?

Asian economies’ geographical proximity to China suggests higher tariffs on China would be the most detrimental, but this is not true for all economies. If we exclude China’s own value added, then Australia and Vietnam are more exposed to China than to Mexico and Canada. For many other Asian economies, higher US tariffs on Mexico and Canada would be worse than US tariffs on China. This list includes Malaysia, Thailand, the Philippines, Japan, India, South Korea and Singapore.

What if Trump imposes a universal tariff on all countries

Vietnam is still the most vulnerable to higher US universal tariffs, with its ultimate exposure standing at 8.9% of its GDP. Other Asian countries vulnerable to higher US universal tariffs include Thailand, Malaysia, Singapore and South Korea.

Which sectors are most at risk from a universal tariff

Higher US universal tariffs would be the most disruptive for Asia’s electronics sector, followed by machinery, autos and textiles. In these sectors, Asia is intricately linked into global value chains that are located across the world.

We see higher tariffs as highly likely. Our US economics team’s base case includes 10% tariffs on Canada and Mexico and a ramp-up of tariffs on China by a cumulative 35 percentage points in 2025, as well as 5% across-the-board tariffs levied in Q2 and Q3 amounting to 10% in total. The impact will vary across Asia, but in an interconnected world, the impact of higher US tariffs will ricochet beyond the target country.

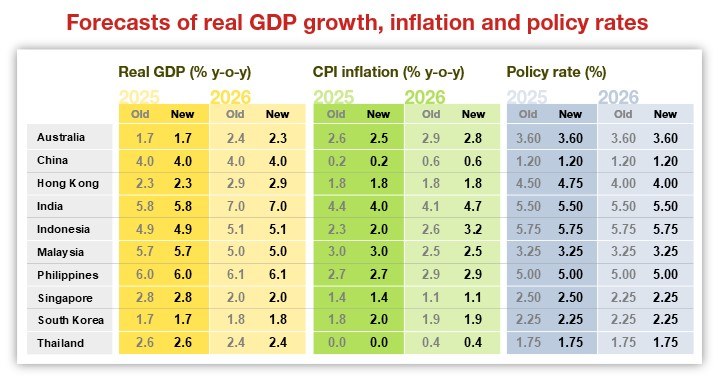

For more on our growth projections, read our full report.

Contributor

Sonal Varma

Chief Economist, India and Asia ex-Japan

Si Ying Toh

Economist, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.