Asia Economic Monthly: China taps Asian demand

Asia is importing more from but exporting less to China.

- Asia’s imports from China have risen to 21.3% of its total, up from 15% a decade ago.

- The key reasons for this include China’s industrial overcapacity, strong Asian domestic demand and the ongoing supply chain reconfiguration.

- Important medium-term implications are China exporting deflation into Asia, rising pressure on local producers, and higher investment flows from China into the rest of Asia.

Asia’s trade relationship with China is undergoing a structural shift. Economies within the region are exporting less to China, due to a slowdown in China-centric processing trade and a moderation of domestic demand. At the same time, Asia is importing more from China. In February 2024, China’s share of Asia’s total imports stood at 21.3%, up from 15% a decade ago. This 6.3 percentage point rise contrasts with a 0.6 percentage point fall in China’s share of Asia’s exports during the same period.

The divergence has caused a sharp deterioration in Asia’s trade balance with China, resulting in a deficit of US$192.6 billion in 2023, down from a surplus of US$24.5 billion in 2013. Seven out of nine Asian economies ran trade deficits with China in 2023.

China’s demand for green metals and chips has benefited Indonesia and Taiwan, respectively. Taiwan continues to run the largest trade surplus with China. Indonesia runs a trade deficit with China, but there has been an improvement in the trend due to a rise in its exports of coal, iron and steel, and nickel to China.

Asia is importing more from China

There are four major reasons why Asia is importing more from China, according to Nomura’s analysis.

- China’s overcapacity. China currently has overcapacity across both consumer and capital goods sectors. There has been a significant rise in China’s trade surplus, a symptom of excess capacity, in machinery, chemicals and road vehicles since 2020. Tensions between the US and China may have nudged the latter to divert exports to Asia due to its geographical proximity.

- Green energy imports are on the rise. Electric vehicle usage is still low in many Asian economies, but it is on an uptrend. Chinese EV makers are capturing the rising local share, due to a lower cost of products and a good quality mix.

- Strong Asian demand. China is also taking advantage of the rapid domestic demand growth in Asia. India is currently one of the fastest growing economies in Asia, with Chinese imports of industrial goods propping its infrastructure development.

- Reconfiguring supply chains. Though supply chain diversification away from China is underway, the nation is still well embedded in these reshuffled supply chains, less as a final assembler of goods and more as an intermediary, as Chinese firms look to bypass trade tariffs and diversify risk.

Medium-term implications

The trend of Asia exporting less to China while importing more from the country has important medium-term implications.

- Exporting deflation. As Asia imports more Chinese consumer goods, China might also be keeping inflation at bay for the region. In Thailand, the central bank believes that competition from China’s cheap imported consumer goods may be a structural factor that is keeping Thailand’s inflation low.

- Pressure on domestic producers. Rising imports from China could hurt domestic manufacturing sectors in Asia. Imports could also make it harder for the domestic manufacturing systems to develop or for local manufacturing jobs to be created.

- Asian protectionism. Costs from higher imports, such as jobs and production losses, may start to outweigh the benefits of cheaper goods, risking a protectionist backlash from some Asian countries.

- Shifting direction of investment flows. Typically, investment flows shadow trade flows. As China exports more to Southeast Asia, Chinese direct investment into these economies is likely to pick up. Some early evidence of this is already visible in Vietnam, Thailand and Indonesia.

- Geopolitical alignment. A shift in Asia’s trade and investment patterns could result in a corresponding shift in some Asian economies’ geopolitical alignment between the US and China.

- Mitigating supply chain risk. Asian countries could look to diversify their imports from China to reduce dependence on one country and mitigate their own supply chain risk.

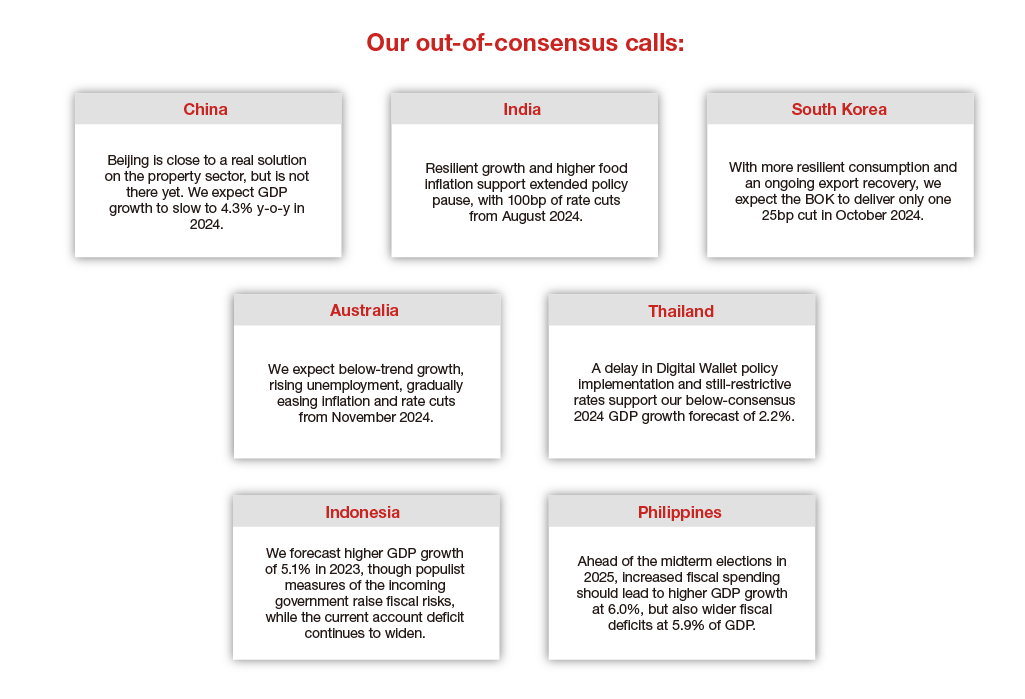

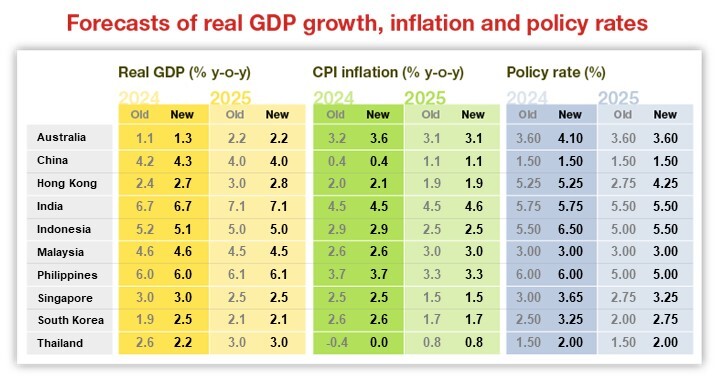

For more on our growth projections, read our full report.

Contributor

Sonal Varma

Chief Economist, India and Asia ex-Japan

Si Ying Toh

Economist, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.