Download the PDF to read the full white paper

New directions: diversification of alternative risk premia strategies

- Despite recent market turbulence, findings from a recent survey conducted by Nomura and Risk.net, shows that investor interest in risk premia strategies remains unaffected

- Alternative risk premia strategies invest in the market according to well-known underlying performance drivers that exist within asset classes such as value, momentum, volatility, trend, carry and size

Despite a difficult year, investors remain keen to use alternative risk premia strategies. However, current approaches may be less diversified than they appear, especially given cross-contamination in cash equity factors. According to Nomura, a more diversified approach making use of fixed income has led to better returns and a more resilient portfolio.

The search for alternative sources of return and greater diversification has piqued investor interest in the alternatives space in recent years. Rather than allocating capital solely according to asset class benchmarks, alternative risk premia strategies invest in the market according to well-known underlying performance drivers that exist within these asset classes. As such, these programmes invest systematically according to long/short factors such as value, momentum, volatility, trend, carry and size.

The growing interest in risk premia investing is a result of stretched valuations in standard asset classes.

“Equities and bonds both look expensive relative to historical norms, and underperformance is likely. Investors are looking for alternatives as they cannot rely on negative correlation between bonds and equities in risk off events as they once did.”

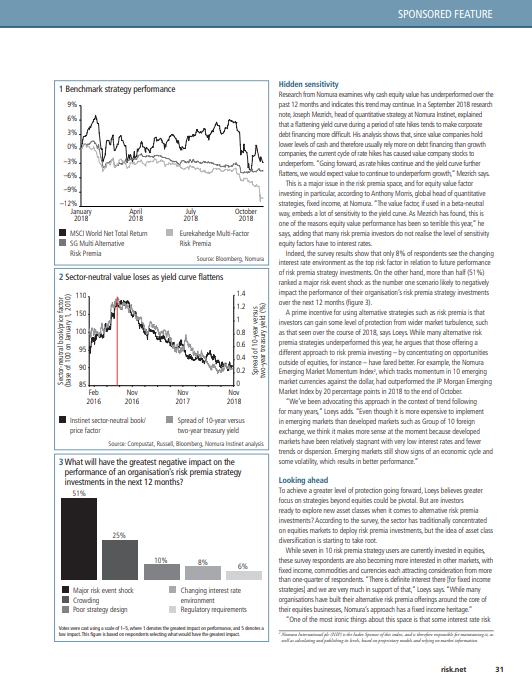

However, performance among many alternative risk premia products has been weak for most of 2018. Many suffered during the sharp equity reversal in February, then recovered somewhat before experiencing further losses starting from late April – in particular with the equity sell-off in October.

Despite recent market turbulence, investor interest in risk premia strategies remains undimmed. A survey of more than 70 investment professionals undertaken in October 2018 by Nomura and Risk.net showed confidence in this type of strategy, with 93% of respondents reporting confidence unchanged or higher in the past 12 months. In fact, allocations to risk premia strategies are set to increase to some degree over the next year at 64% of the organisations polled, according to the survey.

Nomura and Risk.net sought the views of asset managers, hedge funds, pension funds, banks, insurers and family offices. Of those that completed the survey, 63% already use risk premia strategies, while 37% are currently considering this type of investment.

This article has been produced in partnership with Risk.net.

Contributor

Anthony Morris

Global Head of Quantitative Strategies, Fixed Income

Steven Loeys

Head of Index Structuring, EMEA