How a Unique Financing Reduced Costs for Taiwan’s GlobalWafers

- First ever exchangeable issuance out of Taiwan with an overseas underlying

- The lowest coupon achieved amongst all EMEA corporate equity-linked issuance in the last c.14 months

- Structure offers the chance to potentially monetize shares at a 30% premium to the reference price

Nomura’s role as the Sole Global Coordinator and Sole Bookrunner on a EUR345mn Exchangeable Units Offering by Taiwan’s GlobalWafers will help the world’s third biggest silicon wafer maker reduce and optimize financing costs as it implements its EUR3bn capex plan.

Proceeds from the Exchangeable Units will refinance existing debt at a cheaper, fixed financing cost of 1.50%, about 120bps lower than the 3-year Euro swap rate on the pricing date.

GlobalWafers accumulated a 13.7% stake or 4.1mn shares of Siltronic AG - the world’s fourth largest and Europe’s largest silicon wafer manufacturer - through on market purchases and equity derivative transactions over a period of time. GlobalWafers launched a EUR4.35bn tender offer for Siltronic in December 2020.

Ultimately, the deal didn’t receive all the necessary regulatory approvals, as is often the case with cross-border M&A in sensitive technology industries, so Nomura helped GlobalWafers issue Exchangeable Units as a proactive way to efficiently manage its holding of Frankfurt-listed Siltronic AG shares and recycle the capital to optimize its capex funding costs.

“We understand this is the first ever exchangeable issuance out of Taiwan companies into an overseas listed underlying,” says Doris Hsu, CEO of GlobalWafers. “We have high trust in Nomura’s expertise and ability to consistently think from our perspective, anticipate our potential concerns to quickly come up with solutions and make the overall issuance process much more efficient, with an outcome beyond our expectation.”

In Ja Lim, Head of Equity-Linked for Asia ex-Japan at Nomura Lim explains that equity-linked financing is a particularly efficient capital markets instrument when interest rates are high, the share price is undervalued and stock volatility is elevated.

“We have a long-term relationship with GlobalWafers having advised them on various M&A, equity and equity-linked transactions over the years,” she says. “We proposed a unique solution that involved navigating multiple legal jurisdictions, and complex cross-border tax and accounting considerations.”

As well as refinancing of debt at a cheaper cost, GlobalWafers retained further upside in the shares and the chance to potentially monetize shares at a significant 30% premium to the reference price. That’s on top of the recent stock rally that left the stock at 18-month-highs.

“We adjusted that standard exchangeable bond issuance structure to effectively replicate a covered call but in the public market,” says Keyvan Zolfaghari, Head of Equity Solutions for EMEA at Nomura. “This enabled GlobalWafers to achieve the lowest coupon amongst all EMEA corporate equity-linked issuance in the last year.”

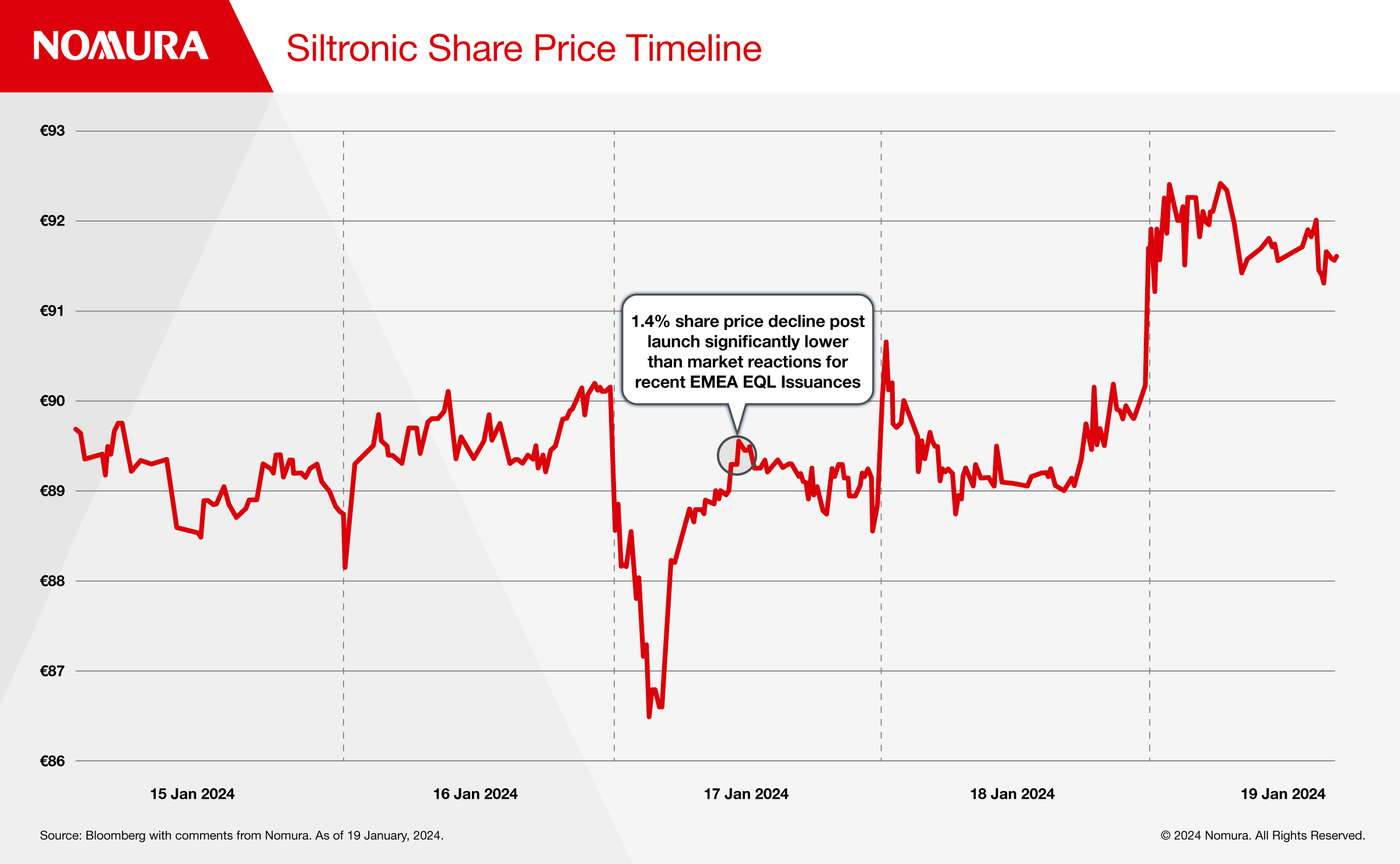

The deal was priced aggressively despite volatile market conditions, demonstrating Nomura’s expert market insights and strong distribution capability. Nomura procured a long-only investor for all equity hedging at a tight discount to minimize market impact, which helped maximize demand on the Exchangeable Units and ensure a smooth aftermarket performance.

The Siltronic share price performed well against the overall market the day after issuance, especially considering large swings seen on recent equity-linked deals. The stock closed down 1.4% versus a 0.8% drop in the German Dax Index, marking the lowest stock price impact of any equity-linked deal in the last quarter (average impact of -6.7%), despite representing c. 20x average daily trading volume.

GlobalWafers Co Ltd was established in 2011 following its spin-off from Sino-American Silicon Products Inc and has a current market cap of about $8bn while Siltronic AG, which partners with many of the leading semiconductor companies and operates production sites in Asia, Europe and the USA, has a market cap of about $3bn.

Silicon wafers form the basis for modern microelectronics and nanoelectronics and are a key component in semiconductor chips driving computers, smartphones, navigation systems and many other applications.

“There’s a lot of room for exchangeables in the current market with higher interest rates,” says Zolfaghari. “They provide efficient capital recycling for cross holdings when there is an impediment to selling.”

To gain further insights into exchangeable units, please contact In Ja Lim or Keyvan Zolfaghari.

Contributor

In Ja Lim

Head of Equity-Linked for Asia ex-Japan

Keyvan Zolfaghari

Head of Equity Solutions for EMEA